The Philippine tourism industry just received a major boost with the launch of the Turismo Asenso multipurpose loan program. This groundbreaking initiative, developed through a partnership between the Department of Tourism (DOT), Department of Trade and Industry (DTI), and Small Business Corporation (SBCorp), offers tourism micro, small, and medium enterprises (MSMEs) access to up to ₱20 million in low-interest financing.

What is the Turismo Asenso Loan Program?

The Turismo Asenso loan program is a specialized financing solution designed to help tourism MSMEs scale up their business operations and improve service quality for tourists. Launched following the successful signing of a Memorandum of Agreement between DOT and DTI in April 2025, this program represents a significant step toward strengthening the Philippines’ tourism economy.

Loan Terms and Benefits

Loan Amount

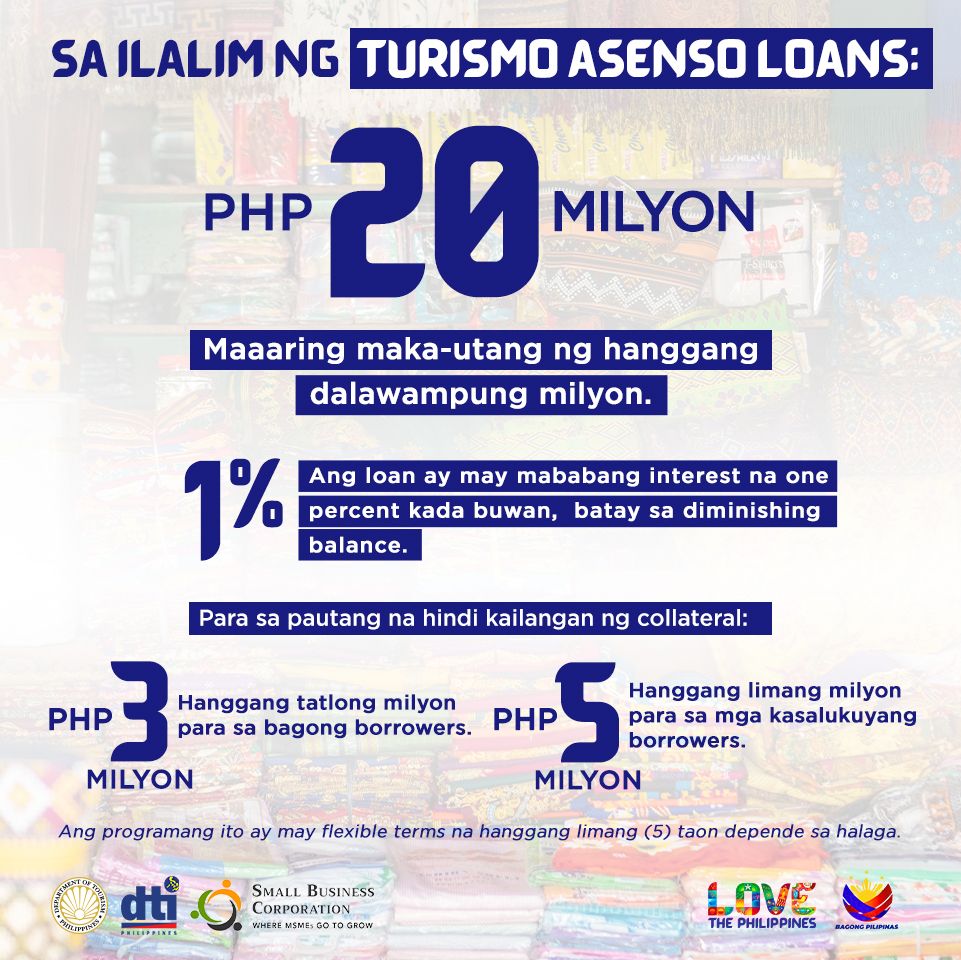

- Maximum loan: Up to ₱20 million

- Non-collateral loans: Up to ₱3 million for new borrowers, ₱5 million for existing borrowers

Interest Rate and Repayment

- Competitive interest rate: 1% per month on diminishing balance basis

- Flexible repayment terms: Up to 5 years

- Low-interest financing designed specifically for tourism businesses

Who Can Apply for Turismo Asenso Loans?

To qualify for the Turismo Asenso loan program, applicants must meet the following requirements:

Business Ownership Requirements

- Filipino-owned registered business OR at least 60% Filipino ownership

- Business track record of minimum one year

- Asset size not exceeding ₱100 million (excluding lot value)

Credit Requirements

- No past due accounts with any SBCorp programs

- No major negative credit findings

- Clean credit history with financial institutions

Economic Impact of Tourism MSMEs

Tourism Secretary Christina Garcia Frasco emphasized the program’s importance, noting that tourism contributes 8.9% to the Philippines’ GDP and provides employment to over 6.75 million Filipinos. This makes tourism MSMEs crucial drivers of economic growth and job creation across the archipelago.

“With tourism contributing 8.9% to our GDP and providing jobs to over 6.75 million Filipinos, our approach has always been to grow tourism as a powerful economic driver. The Turismo Asenso loan program is part of this vision—giving our tourism MSMEs the capital they need to expand, hire more people, and improve services,” Secretary Frasco stated.

How Tourism Businesses Can Benefit

The Turismo Asenso loan program enables tourism MSMEs to:

Business Expansion Opportunities

- Scale up operations to accommodate more tourists

- Hire additional staff to improve service delivery

- Enhance facilities and tourist amenities

- Expand service offerings to attract diverse market segments

Service Quality Improvements

- Upgrade equipment and technology

- Invest in staff training and development

- Implement sustainable tourism practices

- Meet international service standards

Application Process

Interested tourism MSMEs can apply for the Turismo Asenso loan program through the official SBCorp online platform:

Apply online: https://brs.sbcorp.ph

Required Documentation

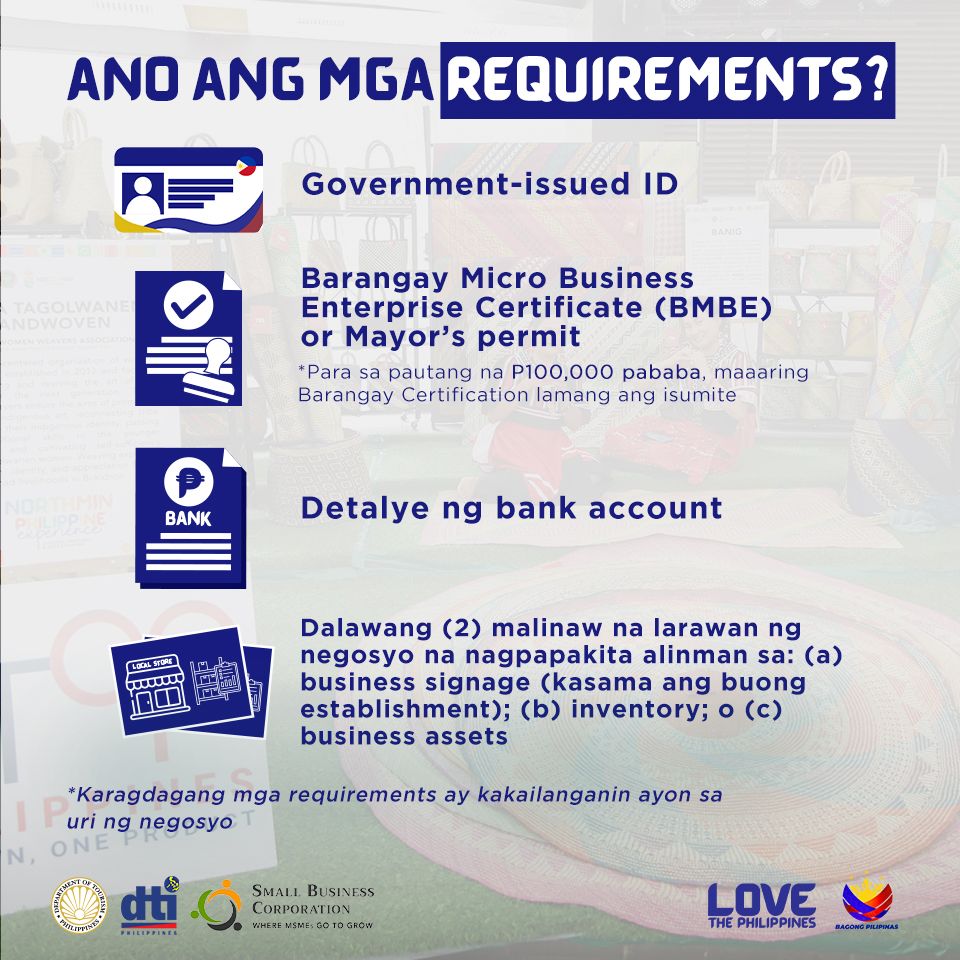

While specific document requirements should be confirmed during application, typical MSME loan applications require:

- Business registration documents

- Financial statements

- Tax returns and BIR certificates

- Business permits and licenses

- Project proposal or business plan

Why Choose Turismo Asenso Loans?

Government-Backed Support

- Partnership between DOT, DTI, and SBCorp

- Specialized program for tourism sector needs

- Commitment to tourism industry growth

Competitive Financing Terms

- Low 1% monthly interest on diminishing balance

- Flexible 5-year repayment options

- High loan amounts up to ₱20 million

- Non-collateral options available

Economic Development Focus

- Supports job creation in tourism sector

- Enhances service quality for tourists

- Contributes to GDP growth through tourism

- Strengthens local communities dependent on tourism

Tourism MSME Success Through Turismo Asenso

The Turismo Asenso loan program represents more than just financing—it’s an investment in the future of Philippine tourism. By providing accessible capital to tourism MSMEs, the program enables entrepreneurs to:

- Modernize operations to meet evolving tourist expectations

- Create sustainable employment in local communities

- Contribute to destination competitiveness on the global stage

- Build resilient tourism businesses capable of weathering economic challenges

Next Steps for Tourism Entrepreneurs

Tourism MSMEs interested in the Turismo Asenso loan program should:

- Review eligibility requirements carefully

- Prepare necessary documentation for application

- Visit the official application portal at https://brs.sbcorp.ph

- Consult with SBCorp representatives for guidance

- Submit complete applications promptly

Conclusion

The Turismo Asenso loan program marks a pivotal moment for Philippine tourism MSMEs. With up to ₱20 million in low-interest financing available, tourism entrepreneurs now have unprecedented access to the capital needed for business growth and service enhancement.

This initiative demonstrates the government’s commitment to supporting the tourism sector, which employs millions of Filipinos and contributes significantly to national economic growth. For tourism MSMEs ready to scale up operations and improve services, the Turismo Asenso loan program offers the financial foundation for sustainable growth and success.

Ready to grow your tourism business? Apply for the Turismo Asenso loan program today at https://brs.sbcorp.ph .

The Turismo Asenso loan program is a joint initiative of the Department of Tourism (DOT), Department of Trade and Industry (DTI), and Small Business Corporation (SBCorp), designed to empower Filipino tourism MSMEs with accessible financing for business growth and service enhancement.